Who Captures the Power of Pen?

We study how government control affects the roles of the media as an information intermediary and a corporate monitor. Comparing a large sample of news articles written by state-controlled and market-oriented Chinese media, we find that articles by the market-oriented media are more critical, more accurate, more comprehensive, and timelier than those by the state-controlled media. Moreover, only articles by the market-oriented media have a significant corporate governance impact. Subsample analyses, interviews with journalists, and a survey of university students suggest that the market-oriented media’s superior effects are explained by their operating efficiency and independence.

The media play important roles in capital markets as both an information intermediary and a corporate monitor. However, evidence for these roles is largely limited to a particular type of media: market-oriented media (i.e., outlets controlled by private owners). Given that nearly 86% of the world’s population receives information from the other type of the media—state-controlled media (i.e., outlets controlled by the government)—the question arises of whether these two types of media perform different roles. A recent scandal concerning the 21st Century Business Herald (21世纪经济报道), the largest Chinese market-oriented business newspaper, which was accused of blackmailing listed firms by threatening negative coverage, highlights the importance of this question. In our recent study (You, Zhang, and Zhang, 2018), we attempt to address the question of different roles by examining how state-controlled and market-oriented media perform their informational and corporate governance functions differently with respect to the stock market.

Relying on the unique media market in China, our study is among the first to make this comparison. Furthermore, consistent with cross-country evidence that state-controlled media ownership impairs economic development and credit allocation efficiency (Djankov et al. 2003; Houston, Lin, and Ma 2011), we contribute to the literature by directly identifying operating inefficiency and political control as two critical obstacles inherent to state-controlled media.

Chinese Business Newspapers

We rely on a large hand-collected sample of 210,199 articles by eight major Chinese business newspapers during the 2004–2014 period. We categorize these eight newspapers into two types: state-controlled newspapers [China Securities Journal (中国证券报), Securities Daily (证券日报), Securities Times (证券时报), and Shanghai Securities Journal (上海证券报) and market-oriented newspapers China Business Journal (中国经营报), First Financial Daily (第一财经日报), The Economic Observer (经济观察报), and 21st Century Business Herald (21世纪经济报道)]. This classification is based on ownership structure and control rights obtained from the newspapers’ websites, company filings, and government disclosures.

The four state-controlled newspapers were founded by newspaper offices, which are nonprofit organizations directly owned and controlled by the government. For example, China Securities Journal (中国证券报) is a national securities newspaper founded in October 1992 and owned by Xinhua News Agency (新华社), which is subordinate to the State Council and reports to the Communist Party of China’s Propaganda and Public Information Departments. The China Securities Regulatory Commission (中国证监会) has designated these state-controlled newspapers as the outlets through which publicly listed firms should disclose news. When collecting news reports from the state-controlled newspapers, we focus only on those written by journalists. That is, we exclude media releases from firms because they represent rebroadcasts and do not contain any new information.

The four market-oriented newspapers are either owned or controlled by financial institutions, public companies, or wealthy individuals. None of these financial institutions and public companies are directly owned or controlled by the government. All the market-oriented newspapers have profit-driven objectives. For example, 21st Century Business Herald (21世纪经济报道) was founded in 2000 by Southern Media Group (南方报业集团) and is jointly owned by a public investment company, Fosun Group (复星集团), which is listed on the Hong Kong Stock Exchange.

To measure media coverage characteristics, we manually read 210,199 news articles and record whether a news article’s tone toward a firm is positive, neutral, or negative. In addition, we construct a word list to identify whether a word is positive or negative in terms of tone and definite or ambiguous in terms of accuracy. For each article, we calculate the proportion of negative words, the proportion of definite words, the proportion of ambiguous words, and the log of the total number of words. For the sake of convenience in presentation, we multiply the proportion of different types of words by 1,000. To measure the timeliness of media coverage, we focus on accounting fraud as a specific type of event and calculate the log of the number of days between the actual starting date of fraud and the reporting date of a news article. At the firm level, we count the number of positive and negative articles over each fiscal year and use the difference between the numbers of positive and negative articles scaled by the total number of news articles reported by each type of media as the key measure of the tone of media coverage.

State-controlled Media vs. Market-oriented Media

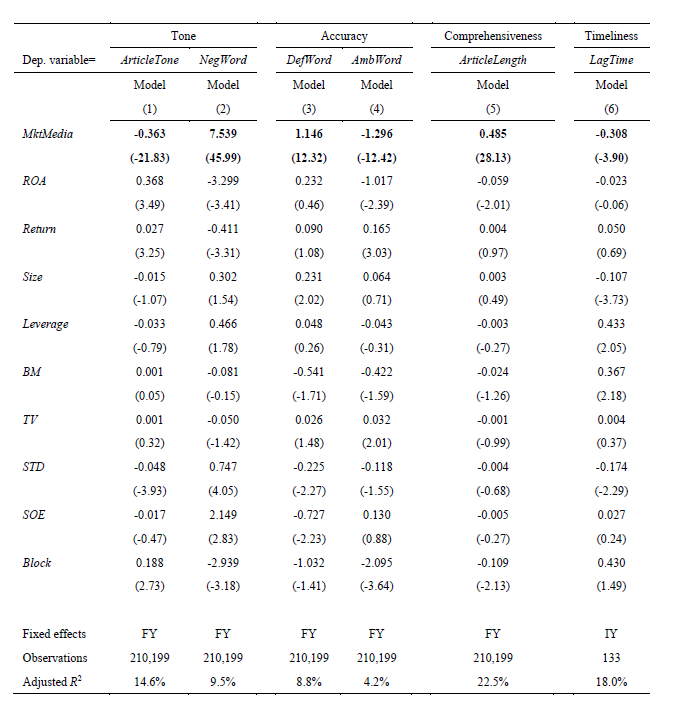

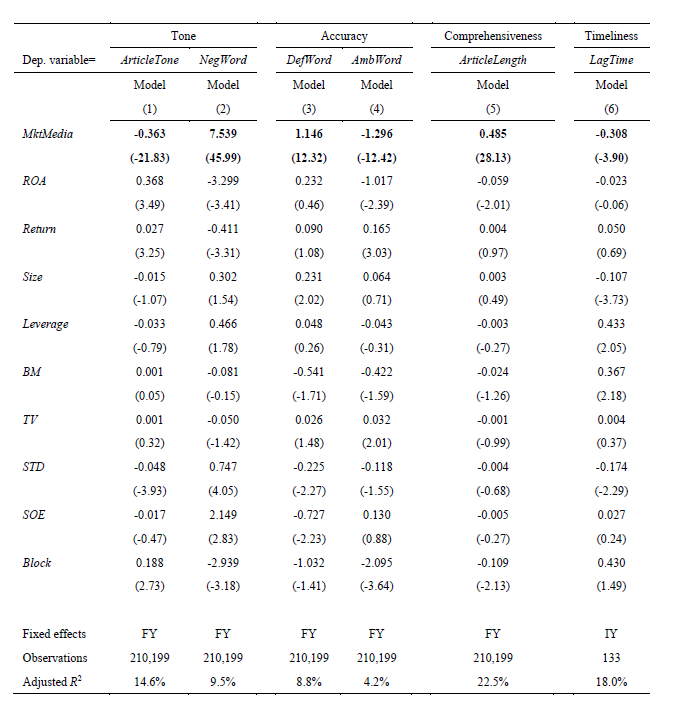

We find that the market-oriented media have more informative coverage. Table 1 shows that articles written by the market-oriented media are more critical (more negative tone or words), more accurate (more definite words or less ambiguous words), more comprehensive (longer article length), and timelier (a short lag between the actual starting date of fraud and the reporting date of a news article). For example, on average, a news article from the market-oriented media has an 89.0% more negative tone, 44.2% more negative words, 7.5% more definite words, 10.2% less ambiguous words, 7.2% more words, and 5.1% less reporting delay time relative to that of an article composed by the state-controlled media. Moreover, the stock price is more responsive to news reports issued by the market-oriented media.

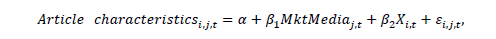

This table presents the panel regression of article characteristics on the dummy variable for the market-oriented media (MktMedia) and firm-level control variables (X), as well as unreported firm (industry) and year fixed effects (FY or IY). The regression model is

where Article characteristicsi,j,t include article tone (ArticleTone), negative words (NegWord), definite words (DefWord), ambiguous words (AmbWord), article length (ArticleLength), and lag time (LagTime); includes return on assets (ROA), annual stock return (Return), firm size (Size), financial leverage (Leverage), book-to-market ratio (BM), stock turnover (TV), stock return volatility (STD), state-owned enterprises (SOE), and block ownership (Block). Key results are highlighted in bold. t-statistics shown in parentheses are based on standard errors adjusted for heteroscedasticity and two-way clustering by firm and date. Obs lists the number of firm-press observations. The sample period is from 2005 to 2014.

We also find that market-oriented media play a more effective role in monitoring managers. We use the likelihood of top executive turnover as an important outcome of corporate governance. We find strong evidence that negative coverage by the market-oriented media not only increases the chance of forced top executive turnover but also ties the sensitivity of the likelihood of top executive turnover to firm performance. The effect is both statistically significant and economically relevant. For example, a one standard deviation decrease in the tone of the market-oriented media leads to a 2.1% (absolute magnitude) or 17.4% (relative magnitude) increase in the likelihood of forced top executive turnover.

To disentangle the causal impact of the media on corporate governance, we present three anecdotal cases for both the market-oriented media and the state-controlled media in China.

Plasticizer scandal of Jiugui Liquor Co Ltd (酒鬼酒公司): On 19 November 2012, a news report from 21st Century Business Herald (21世纪经济报道), one of the four market-oriented media outlets in this study, uncovered that Jiugui liquor (酒鬼酒), made by one of China’s largest liquor makers, Jiugui Liquor Co Ltd (酒鬼酒公司), contained an excessive amount of plasticizer, which can cause serious damage to human immune and reproductive systems. The news report led to a halt in the trading of Jiugui (酒鬼酒公司)’s shares, and the share price of Jiugui Liquor Co Ltd (酒鬼酒公司) dropped by 36% within four days of the disclosure. CEO Xinguo Wang (王新国), CFO and Vice CEO Jun Wang (王俊), and a few other top executives resigned two months after the scandal broke. All the state-controlled media had a delayed reaction regarding this scandal.

Accounting fraud of Jilin Zixin Pharmaceutical Industrial Co Ltd(吉林紫鑫药业有限公司): In 2010, Jilin Zixin Pharmaceutical Industrial Co Ltd (吉林紫鑫药业有限公司) claimed that the company’s financial profits had nearly doubled due to the significant growth in sales of its ginseng products. However, on 6 August 2011, Capital Week (证券市场周刊), a market-oriented newspapers, blew the whistle and revealed that Jilin Zixin (吉林紫鑫) had inflated their earnings through illegal related-party transactions. Following this report, the China Securities Regulatory Commission conducted an investigation on the accounting fraud. Two months later, CEO Chunsheng Guo (郭春生) resigned.

Tainted milk scandal of Sanlu Group Co Ltd (三鹿集团) : In September 2008, Sanlu Group (三鹿集团), one of the largest dairy producers in China, was found to be selling baby formula laced with an industrial additive called melamine, which made 294,000 babies ill and killed six infants. Even after repeated complaints from consumers, the Chinese government restated that Sanlu’s baby formula met the applicable standards. A news report about this scandal surfaced only after Lanzhou Morning Post (兰州晨报), a market-oriented newspaper based in Gansu province, blew the whistle. Within one week of the news report, Sanlu (三鹿) initiated a recall of all its milk products. Three months later, Sanlu (三鹿) declared bankruptcy and the trial of its CEO Tian Wenhua (田文华) began. On 22 January 2009, Tian was sentenced to life imprisonment and fined $2.9 million, and other executives received sentences of five to fifteen years.

These three events show that the market-oriented media play a significant role in monitoring firms’ products, performance, and financial statements, whereas the state-controlled media, according to our findings, have no such effect.

Operating efficiency and independence

To understand the superior information role of market-oriented media, we perform a subsample analysis and find that the market-oriented media play stronger informational and monitoring roles than the state-controlled media, especially with respect to firms with higher information processing costs or those under more severe political control from the government. To obtain additional support from first-hand sources, we conducted phone interviews with 53 journalists from 20 media outlets, as well as an online survey with 372 university students majoring in communication and media studies. The responses of these journalists and students are in line with our findings from the empirical analysis.

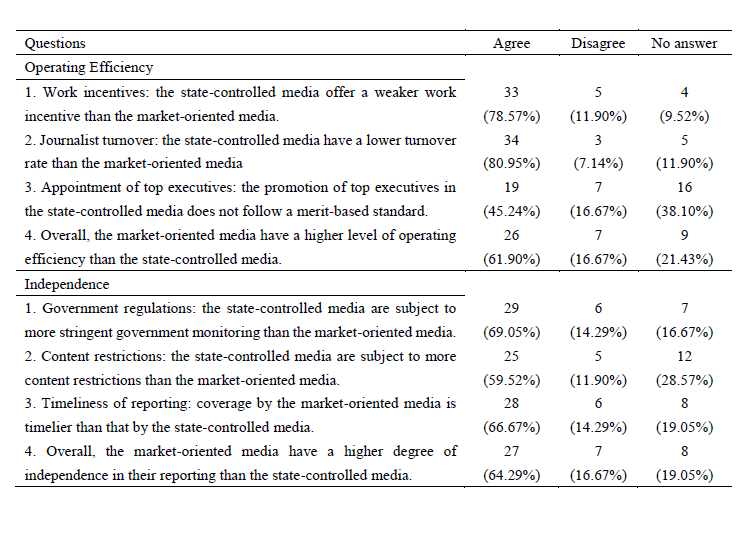

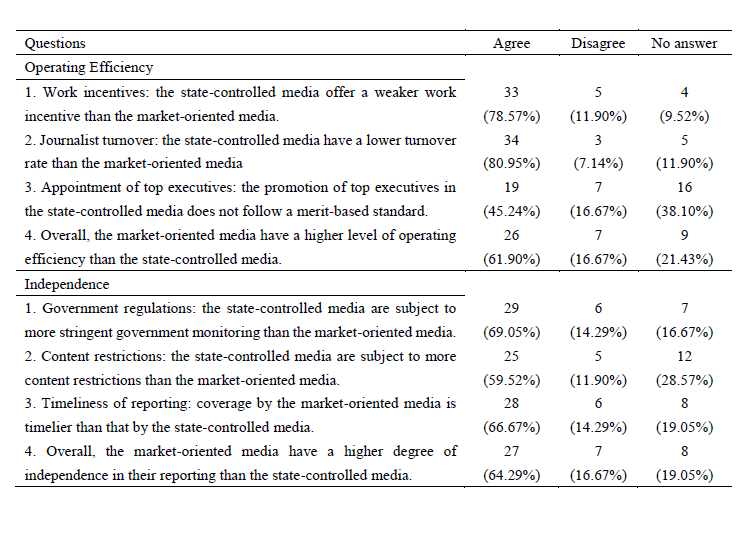

Table 2 shows that 79% of the journalists agree that the state-controlled media offer a weaker incentive for them to write high-quality articles, and the majority of interviewed journalists agree that the state-controlled media are subject more to government regulations (69% of the journalists) and content restrictions (60% of the journalists).

This table presents information collected from phone interviews with journalists. We contacted 53 journalists from 20 media outlets, including newspapers, television stations, and Internet media. Of the 53 journalists, 11 declined our interview request. For the remaining 19 journalists, we conducted phone interviews lasting, on average, 30 minutes. We report these interviewees’ answers to our questions related to the operating efficiency and independence of the media.

In summary, we find that news reports from the market-oriented media are of higher reporting quality, result in a greater price impact, and provide more information about firm fundamentals compared with those from the state-controlled media. Moreover, negative coverage by the market-oriented media has a significant impact on the likelihood of forced executive turnover and other corporate governance outcomes, whereas negative coverage by the state-controlled media does not have the same impact. The results from subsample analyses and phone interviews with journalists suggest that both efficiency and independence contribute to the superior roles of the market-oriented media.

(Jiaxing You, School of Management, Xiamen University; Bohui Zhang, School of Management and Economics, Shenzhen Finance Institute, Chinese University of Hong Kong, Shenzhen; Le Zhang, College of Business and Economics, Australian National University.)

Djankov, S., C. McLiesh, T. Nenova, and A. Shleifer (2003). “Who owns the media?” Journal of Law and Economics 46:341–81.

Houston, J. F., C. Lin, and Y. Ma (2011). “Media ownership, concentration and corruption in bank lending.” Journal of Financial Economics 100:326–50.

The media play important roles in capital markets as both an information intermediary and a corporate monitor. However, evidence for these roles is largely limited to a particular type of media: market-oriented media (i.e., outlets controlled by private owners). Given that nearly 86% of the world’s population receives information from the other type of the media—state-controlled media (i.e., outlets controlled by the government)—the question arises of whether these two types of media perform different roles. A recent scandal concerning the 21st Century Business Herald (21世纪经济报道), the largest Chinese market-oriented business newspaper, which was accused of blackmailing listed firms by threatening negative coverage, highlights the importance of this question. In our recent study (You, Zhang, and Zhang, 2018), we attempt to address the question of different roles by examining how state-controlled and market-oriented media perform their informational and corporate governance functions differently with respect to the stock market.

Relying on the unique media market in China, our study is among the first to make this comparison. Furthermore, consistent with cross-country evidence that state-controlled media ownership impairs economic development and credit allocation efficiency (Djankov et al. 2003; Houston, Lin, and Ma 2011), we contribute to the literature by directly identifying operating inefficiency and political control as two critical obstacles inherent to state-controlled media.

Chinese Business Newspapers

We rely on a large hand-collected sample of 210,199 articles by eight major Chinese business newspapers during the 2004–2014 period. We categorize these eight newspapers into two types: state-controlled newspapers [China Securities Journal (中国证券报), Securities Daily (证券日报), Securities Times (证券时报), and Shanghai Securities Journal (上海证券报) and market-oriented newspapers China Business Journal (中国经营报), First Financial Daily (第一财经日报), The Economic Observer (经济观察报), and 21st Century Business Herald (21世纪经济报道)]. This classification is based on ownership structure and control rights obtained from the newspapers’ websites, company filings, and government disclosures.

The four state-controlled newspapers were founded by newspaper offices, which are nonprofit organizations directly owned and controlled by the government. For example, China Securities Journal (中国证券报) is a national securities newspaper founded in October 1992 and owned by Xinhua News Agency (新华社), which is subordinate to the State Council and reports to the Communist Party of China’s Propaganda and Public Information Departments. The China Securities Regulatory Commission (中国证监会) has designated these state-controlled newspapers as the outlets through which publicly listed firms should disclose news. When collecting news reports from the state-controlled newspapers, we focus only on those written by journalists. That is, we exclude media releases from firms because they represent rebroadcasts and do not contain any new information.

The four market-oriented newspapers are either owned or controlled by financial institutions, public companies, or wealthy individuals. None of these financial institutions and public companies are directly owned or controlled by the government. All the market-oriented newspapers have profit-driven objectives. For example, 21st Century Business Herald (21世纪经济报道) was founded in 2000 by Southern Media Group (南方报业集团) and is jointly owned by a public investment company, Fosun Group (复星集团), which is listed on the Hong Kong Stock Exchange.

To measure media coverage characteristics, we manually read 210,199 news articles and record whether a news article’s tone toward a firm is positive, neutral, or negative. In addition, we construct a word list to identify whether a word is positive or negative in terms of tone and definite or ambiguous in terms of accuracy. For each article, we calculate the proportion of negative words, the proportion of definite words, the proportion of ambiguous words, and the log of the total number of words. For the sake of convenience in presentation, we multiply the proportion of different types of words by 1,000. To measure the timeliness of media coverage, we focus on accounting fraud as a specific type of event and calculate the log of the number of days between the actual starting date of fraud and the reporting date of a news article. At the firm level, we count the number of positive and negative articles over each fiscal year and use the difference between the numbers of positive and negative articles scaled by the total number of news articles reported by each type of media as the key measure of the tone of media coverage.

State-controlled Media vs. Market-oriented Media

We find that the market-oriented media have more informative coverage. Table 1 shows that articles written by the market-oriented media are more critical (more negative tone or words), more accurate (more definite words or less ambiguous words), more comprehensive (longer article length), and timelier (a short lag between the actual starting date of fraud and the reporting date of a news article). For example, on average, a news article from the market-oriented media has an 89.0% more negative tone, 44.2% more negative words, 7.5% more definite words, 10.2% less ambiguous words, 7.2% more words, and 5.1% less reporting delay time relative to that of an article composed by the state-controlled media. Moreover, the stock price is more responsive to news reports issued by the market-oriented media.

Table 1 Market-oriented media, state-controlled media, and article characteristics

We also find that market-oriented media play a more effective role in monitoring managers. We use the likelihood of top executive turnover as an important outcome of corporate governance. We find strong evidence that negative coverage by the market-oriented media not only increases the chance of forced top executive turnover but also ties the sensitivity of the likelihood of top executive turnover to firm performance. The effect is both statistically significant and economically relevant. For example, a one standard deviation decrease in the tone of the market-oriented media leads to a 2.1% (absolute magnitude) or 17.4% (relative magnitude) increase in the likelihood of forced top executive turnover.

To disentangle the causal impact of the media on corporate governance, we present three anecdotal cases for both the market-oriented media and the state-controlled media in China.

Plasticizer scandal of Jiugui Liquor Co Ltd (酒鬼酒公司): On 19 November 2012, a news report from 21st Century Business Herald (21世纪经济报道), one of the four market-oriented media outlets in this study, uncovered that Jiugui liquor (酒鬼酒), made by one of China’s largest liquor makers, Jiugui Liquor Co Ltd (酒鬼酒公司), contained an excessive amount of plasticizer, which can cause serious damage to human immune and reproductive systems. The news report led to a halt in the trading of Jiugui (酒鬼酒公司)’s shares, and the share price of Jiugui Liquor Co Ltd (酒鬼酒公司) dropped by 36% within four days of the disclosure. CEO Xinguo Wang (王新国), CFO and Vice CEO Jun Wang (王俊), and a few other top executives resigned two months after the scandal broke. All the state-controlled media had a delayed reaction regarding this scandal.

Accounting fraud of Jilin Zixin Pharmaceutical Industrial Co Ltd(吉林紫鑫药业有限公司): In 2010, Jilin Zixin Pharmaceutical Industrial Co Ltd (吉林紫鑫药业有限公司) claimed that the company’s financial profits had nearly doubled due to the significant growth in sales of its ginseng products. However, on 6 August 2011, Capital Week (证券市场周刊), a market-oriented newspapers, blew the whistle and revealed that Jilin Zixin (吉林紫鑫) had inflated their earnings through illegal related-party transactions. Following this report, the China Securities Regulatory Commission conducted an investigation on the accounting fraud. Two months later, CEO Chunsheng Guo (郭春生) resigned.

Tainted milk scandal of Sanlu Group Co Ltd (三鹿集团) : In September 2008, Sanlu Group (三鹿集团), one of the largest dairy producers in China, was found to be selling baby formula laced with an industrial additive called melamine, which made 294,000 babies ill and killed six infants. Even after repeated complaints from consumers, the Chinese government restated that Sanlu’s baby formula met the applicable standards. A news report about this scandal surfaced only after Lanzhou Morning Post (兰州晨报), a market-oriented newspaper based in Gansu province, blew the whistle. Within one week of the news report, Sanlu (三鹿) initiated a recall of all its milk products. Three months later, Sanlu (三鹿) declared bankruptcy and the trial of its CEO Tian Wenhua (田文华) began. On 22 January 2009, Tian was sentenced to life imprisonment and fined $2.9 million, and other executives received sentences of five to fifteen years.

These three events show that the market-oriented media play a significant role in monitoring firms’ products, performance, and financial statements, whereas the state-controlled media, according to our findings, have no such effect.

Operating efficiency and independence

To understand the superior information role of market-oriented media, we perform a subsample analysis and find that the market-oriented media play stronger informational and monitoring roles than the state-controlled media, especially with respect to firms with higher information processing costs or those under more severe political control from the government. To obtain additional support from first-hand sources, we conducted phone interviews with 53 journalists from 20 media outlets, as well as an online survey with 372 university students majoring in communication and media studies. The responses of these journalists and students are in line with our findings from the empirical analysis.

Table 2 shows that 79% of the journalists agree that the state-controlled media offer a weaker incentive for them to write high-quality articles, and the majority of interviewed journalists agree that the state-controlled media are subject more to government regulations (69% of the journalists) and content restrictions (60% of the journalists).

Table 2: Interviews with Journalists

In summary, we find that news reports from the market-oriented media are of higher reporting quality, result in a greater price impact, and provide more information about firm fundamentals compared with those from the state-controlled media. Moreover, negative coverage by the market-oriented media has a significant impact on the likelihood of forced executive turnover and other corporate governance outcomes, whereas negative coverage by the state-controlled media does not have the same impact. The results from subsample analyses and phone interviews with journalists suggest that both efficiency and independence contribute to the superior roles of the market-oriented media.

(Jiaxing You, School of Management, Xiamen University; Bohui Zhang, School of Management and Economics, Shenzhen Finance Institute, Chinese University of Hong Kong, Shenzhen; Le Zhang, College of Business and Economics, Australian National University.)

Djankov, S., C. McLiesh, T. Nenova, and A. Shleifer (2003). “Who owns the media?” Journal of Law and Economics 46:341–81.

Houston, J. F., C. Lin, and Y. Ma (2011). “Media ownership, concentration and corruption in bank lending.” Journal of Financial Economics 100:326–50.

You, J., Zhang, B., and L. Zhang (2018). “Who captures the power of the pen?” Review of Financial Studies 31:43–96.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email