Anxiety or Pain? The Impact of Tariffs and Uncertainty on Chinese Firms in the Trade War

We analyze the firm-level impacts of the US-China trade war since it is of great economic importance to understand how the unprecedented and dramatic increases in the import and export tariffs confronting Chinese firms affected the firm-level policy environment and firm operational outcomes. To contribute to this effort, we study how increases in US tariffs and Chinese retaliatory tariffs raised Chinese firms’ trade policy uncertainty (TPU) and document how firm-level increases in TPU were ameliorated by firm size and capital intensity, as well as by firm-level export diversification in terms of partner countries. In turn, we show how increases in firm trade policy uncertainty due to the US-China trade war depressed Chinese firm-level investment, R&D expenditures, and profits.

The US-China trade war since 2018, by rupturing and reversing decades of progress toward trade liberalization and by setting tariffs in a fashion that violated the rules and norms of WTO practice, dramatically raised the uncertainty facing economic agents (IMF 2018). The trade policy uncertainty (TPU) surrounding this trade tension is now hitting global investment and economic growth, and the effect from the rise in TPU could be a more important driver of the slowdown than the tariffs themselves.

To understand the magnitude of the economic effects linked to TPU, several recent academic papers have used the uncertainty surrounding US tariff preferences toward China around China’s WTO entry (e.g., Handley and Limão 2015; Pierce and Schott 2016; Feng, Li, and Swenson 2017). However, little is known about the underlying mechanisms by which TPU is raised across producers. An important contribution of our paper is to construct a time-varying measure of TPU at the firm-level and to investigate the mechanisms through the lens of exposure to import and export tariffs. For this purpose, we use firm-level international trade transaction data, product-level trade war tariff dataset, firm-level uncertainty measures, and quarterly and up-to-date firm-level outcome data on Chinese listed firms. A key advantage of focusing on listed firms is that one can produce the TPU measure in a timely manner (see Note 1).

Measuring Trade Policy Uncertainty

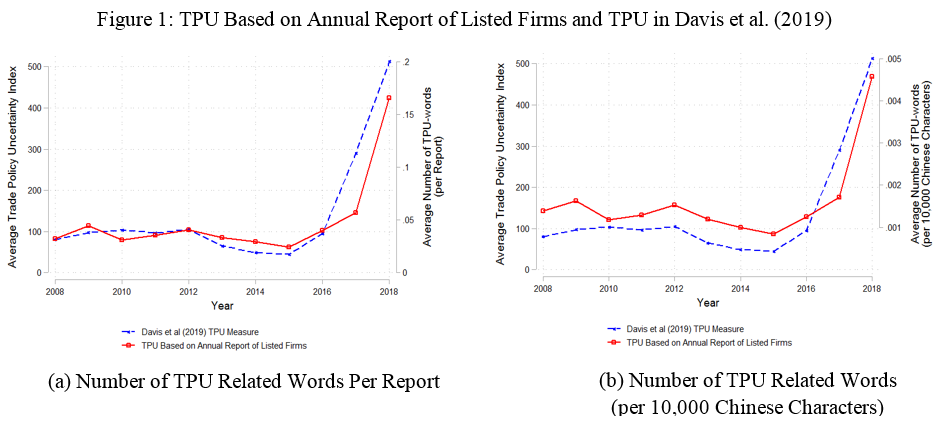

To analyze how rising tariffs affect TPU and firm performance, Benguria et al. (2020) employ the method of Hassan et al. (2019, 2020) and Caldara et al. (2019) to construct a firm-level, time-varying measure of TPU. This approach applies a textual analysis of transcripts of annual reports released by Chinese listed firms for each year between 2008 and 2018. We identify instances of TPU through the close in- or next-line proximity of words related to trade policy (tariff, protectionism, anti-dumping, etc.) and text related to uncertainty (uncertainty, threat, risks, unknown, etc.), and create annual counts of TPU-related keywords for each firm. To test the external validity, we aggregate our firm-level series to create a national index and compare it with Davis et al. (2019). We plot the two series in Figure 1. Notably, the two series evolve closely, both when we create our index based on the total number of TPU instances (panel a) or the number of TPU instances normalized by the length of each report (panel b). Both series are fairly flat prior to 2016. In contrast, following Trump’s election in November 2016, the TPU index based on annual reports increases by more than 300% between 2016 and 2018.

Methodology

With these measures in hand, we adopt a differences-in-differences approach to investigate the impact of trade war tariffs on firm-level TPU and how changes in TPU affect firm operational outcomes. Lastly, we evaluate how trade war tariffs affect the performance of Chinese firms by distinguishing the direct impact of tariff change on firm performance from the indirect impact that is mediated through the effect that tariff change has on TPU. To this end, we regress firm outcome on both tariffs and TPU along with control variables.

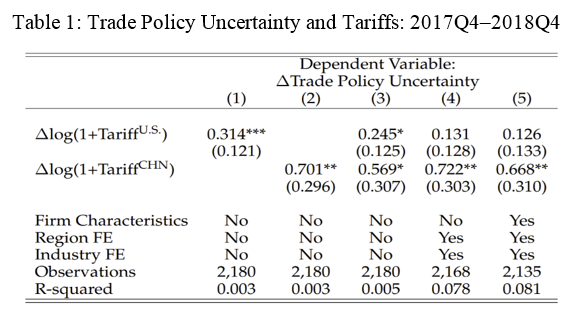

Endogenous Trade Policy Uncertainty

How do tariff changes influence firms’ perceptions about TPU? This is summarized in Table 1. The coefficient is positive and statistically significant, implying that US tariffs, which act as a barrier on Chinese exports to the US, increase TPU. What is the magnitude of such an effect? The coefficient of 0.314 in column (1) indicates that a 10 percentage point increase in the US tariff exposure measure is associated with 0.074 standard deviation increase in TPU. In column (2), the coefficient of 0.701 indicates that a 10 percentage point increase in Chinese tariff exposure measure is also associated with 0.165 standard deviation increase in TPU (see Note 2).

However, there is substantial heterogeneity in firms’ perceptions of TPU. Further work in our project reveals that TPU damage is greatest for firms with lower capital intensity, smaller revenues, and lower productivity. One explanation for this differential effect is that these firms may have benefited most from previous trade liberalization that facilitated their ability to use US sourcing to improve the quality of their products. Consequently, if Chinese firms were sourcing optimally before the trade war, the reversal of opportunities due to the trade war predicts such a pattern (Fan, Li, and Yeaple 2018).

Hedging via Trade Diversification?

Our results show that while firms exporting to more countries registered smaller increases in TPU, we find no evidence suggesting that importing from more countries mitigates the impact of Chinese tariffs on TPU. We speculate that export diversification provided a natural hedge against negative trade war export demand shocks. However, this hedging was not without limit since it appears that firms with excessive dependence on US sales were less insulated, due to the fixed costs of quickly locating and entering new markets as US sales declined. The absence of a hedging effect on the import side may imply that trade policy supply shocks were more difficult to hedge against. If the US was a source of customized parts, diversification opportunities would be more limited.

Impact of TPU on Economic Outcomes

In the second part of our analysis, we study how heightened TPU, which originated from the 2018–19 trade war, discouraged firm-level investment and R&D expenditures. Our results show that the adverse trade war impacts grew over time. We also find that, over time, TPU led to profit erosion and losses. The effects are not small, as our work suggests that Chinese firms hit by a one standard deviation increase in TPU during the trade war reduced firm-level investment, R&D expenditures, and profits by 1.4, 2.7, and 8.9 percent, respectively.

Direct Versus Indirect Impacts of Trade War Tariffs on Economic Outcomes

In contrast, we find little evidence of the direct impacts of US and Chinese tariff exposure measures on firm performance. Several factors could explain the absence of direct tariff impacts. For instance, the null direct impact could be due to the low average ratio of exports to the US to total sales for Chinese listed firms. A second explanation could be that a third country may have been chosen by Chinese exporters to re-route their exports (Chau and Boudreau 2019).

Conclusion

Overall, our work highlights the importance of the TPU channel during the ongoing US-China trade war; the paper also illustrates the benefits of new measures of firm-level uncertainty based on textual analysis of firm statements (Hassan et al. 2019, 2020; Caldara et al. 2019). The documented, stylized facts contribute to understanding how firms respond to rising TPU, which can be used later as models of dynamic endogenous effects of TPU are developed.

Importantly, as one of our contributions, in this paper, we try to open the TPU black box. While it has been generally acknowledged that TPU must have played a role in the trade war (IMF 2018), there is little understanding of how the process works, the magnitude of this channel, and which firms are most exposed to it. We move one step in this direction and take advantage of the variation across Chinese firms in their exposure to the trade war. We show that firm-level increases in TPU experienced during this period are systematically associated with firm-level exposure to both US tariffs and Chinese tariffs.

Note 1: In particular, Handley and Li (2018) construct a time-varying measure of firm-specific idiosyncratic uncertainty from analyzing the text of company reports filed with the U.S. Securities and Exchange Commission. However, our focus is the trade policy uncertainty that is in line with Caldara et al. (2019).

Note 2: The dependent variable is the change in firm-level trade policy uncertainty between 2017Q4 and 2018Q4. TariffU.S. denotes the firm-level measure of exposure to U.S. tariffs on imports from China, computed as a weighted average across each firm’s set of products exported to the US TariffCHN denotes the firm-level measure of exposure to Chinese tariffs on imports from the US, computed as a weighted average across each firm’s set of products imported from the US ∆ln(1+TariffU.S.) and ∆ln(1+TariffCHN) are percent changes in TariffU.S. and TariffCHN between 2017Q4 and 2018Q4. Firm characteristics include profit, revenue, and capital, and are measured in 2017Q4. Industries are defined according to the three-digit Standard Industrial Classification (SIC). Robust standard errors are in parentheses.

(Felipe Benguria, University of Kentucky; Jaerim Choi, University of Hawaii at Manoa; Deborah Swenson, University of California, Davis; Mingzhi Xu, Peking University.)

References

Benguria, Felipe, Jaerim Choi, Deborah L. Swenson, and Mingzhi Xu. 2020. “Anxiety or Pain? The Impact of Tariffs and Uncertainty on Chinese Firms in the Trade War.” NBER Working Paper No. 27920. https://www.nber.org/papers/w27920.

Caldara, Dario, Matteo Iacoviello, Patrick Molligo, Andrea Prestipino, and Andrea Raffo. 2019. “The Economic Effects of Trade Policy Uncertainty.” Journal of Monetary Economics 109 (January 2020): 38–59. https://doi.org/10.1016/j.jmoneco.2019.11.002.

Chau, Mai Ngoc, and John Boudreau. 2019. “Chinese Exporters Dodge Tariffs with Fake Made-in-Vietnam Labels,” Bloomberg, June 9, 2019. https://www.bloomberg.com/news/articles/2019-06-10/vietnam-cracks-down-on-chinese-made-goods-being-shipped-to-u-s.

Davis, Steven J., Dingqian Liu, and Xuguang S. Sheng. 2019. “Economic Policy Uncertainty in China Since 1949: The View from Mainland Newspapers.” Stanford University Working Paper. https://site.stanford.edu/sites/g/files/sbiybj8706/f/5331-economic_policy_uncertainty_in_chia_since_1949-the_view_from_mainland_newspapers.pdf.

Fan, Haichao, Yao Amber Li, and Stephen R. Yeaple. 2018. “On the Relationship between Quality and Productivity: Evidence from China’s Accession to the WTO.” Journal of International Economics 110 (January): 28–49. https://doi.org/10.1016/j.jinteco.2017.10.001.

Feng, Ling, Zhiyuan Li, and Deborah L Swenson. 2017. “Trade Policy Uncertainty and Exports: Evidence from China’s WTO Accession.” Journal of International Economics 106 (May): 20–36. https://doi.org/10.1016/j.jinteco.2016.12.009.

Handley, Kyle, and Nuno Lim?o. 2015. “Trade and Investment under Policy Uncertainty: Theory and Firm Evidence.” American Economic Journal: Economic Policy 7, no. 4 (November): 189–222. https://doi.org/10.1257/pol.20140068.

Handley, Kyle, and J. Frank Li. 2020. “Measuring the effects of firm uncertainty on economic activity: New evidence from one million documents.” NBER Working Paper No. 27896. https://www.nber.org/papers/w27896.

Hassan, Tarek A., Stephan Hollander, Laurence van Lent, and Ahmed Tahoun. 2019. “Firm-Level Political Risk: Measurement and Effects.” Quarterly Journal of Economics 134, no. 4 (November): 2135–2202. https://doi.org/10.1093/qje/qjz021.

Hassan, Tarek Alexander, Stephan Hollander, Laurence van Lent, and Ahmed Tahoun. 2020. “The Global Impact of Brexit Uncertainty.” NBER Working Paper No. 26609. https://www.nber.org/papers/w26609.

Pierce, Justin, and Peter K. Schott. 2016. “The Surprisingly Swift Decline of US Manufacturing Employment.” American Economic Review 106, no. 7 (July): 1632–62. https://doi.org/10.1257/aer.20131578.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email