Foreign Business Exposure, Policy Uncertainty, and Capital Flight from Home: Evidence from China

Using subsidiary-level data of 3,863 Chinese nonfinancial firms from 2000 to 2019, we show that the multinationals have 5.3% higher capital expenditures than the domestic firms relative to the average. The multinational firms’ offshore investment increases with policy uncertainty about the domestic markets. Our analysis suggests that in the face of domestic uncertainty, multinational firms switch to their offshore markets as a leeway to reallocate investment rather than as a response to offshore investment opportunities, as a way to access to foreign capital, or due to competition in the domestic market.

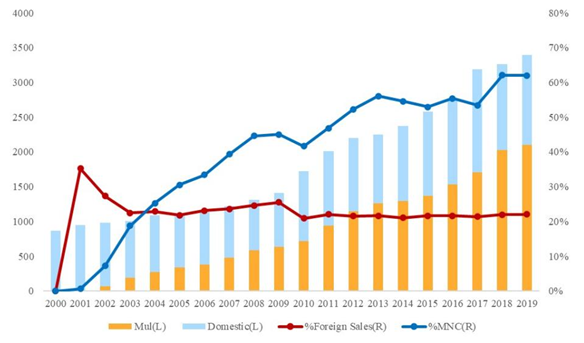

Since China joined the World Trade Organization (WTO) in 2001, its share of global trade has surged from less than 1% to nearly 15%. Moreover, recent years have witnessed a remarkable rise of Chinese multinational firms (see Note 1). As shown in Figure 1, the number of listed firms almost quadrupled from 2000 to 2019. Among the newly listed firms, the proportion of multinational firms increased from zero to around 60% of all firms, and foreign sales persistently account for around 22% of the multinationals’ total sales.

Figure 1: Growth of Multinational Firms and Foreign Sales in China

Figure 1 plots the growth of multinational firms and foreign sales in China over 2000–2019. The blue bar depicts the number of domestic firms and the orange bar shows the number of multinational firms. The blue line shows the portion of multinational firms, and the red line shows the average ratio of foreign sales to total sales of multinational firms.

Since 2016, China has witnessed a dramatic swing from net capital inflows to large net outflows, which attracts widespread concern about the stability of China’s capital markets. The debate focuses on the underlying factors that drive the capital exodus (see Note 2). In a dynamic stochastic general equilibrium (DSGE) framework, Tille and Wincoop (2010) argue that the endogenous time variation in expected returns and risks is the key determinant of portfolio choice between home and foreign capital. To the extent that domestic and foreign capital are affected differently, the time-varying risks are an important driving force behind international capital flows. Motivated by the theoretical notion, we empirically evaluate a series of return and risk factors that may shape Chinese multinational firms’ investment allocations between the domestic and foreign markets.

We employ a sample of 3,863 Chinese nonfinancial firms listed on the Shanghai and Shenzhen Stock Exchange in 2000–2019. We investigate whether the firms listed in the Chinese mainland would utilize the offshore markets to transfer their capital overseas, especially when the domestic market features high uncertainty. A firms is considered to be multinational if its foreign sales take up at least 5% of its total sales. In our sample, the multinational firms are mainly in manufacturing, information technology, and mining industries. The United States is the most popular nation for multinational firms to locate their subsidiaries (879 firms). Subsidiaries of 469 firms are in tax havens such as the British Virgin Islands (310 firms) and the Cayman Islands (159 firms).

We find that a one standard deviation increase in a firm’s foreign sales ratio is associated with a 5.3% increase in its capital expenditures. The relations are likely to be causal when we use China’s accession to WTO as an experiment in a DID framework. We also use three alternative instrumental variables for robustness checks.

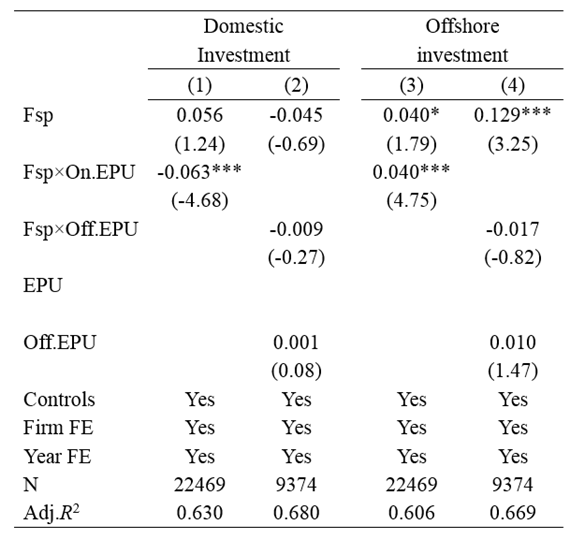

To examine how the multinational firms reallocate investment between domestic and offshore markets, we test four types of uncertainties: economic policy uncertainty (EPU), political uncertainty, financial uncertainty, and the uncertainty of international coordination. We find domestic EPU can effectively explain the investment allocation of Chinese multinational firms. As shown in Table 1, a one-unit increase in the EPU of the Chinese mainland is associated with 6.3% less firm investment in the domestic market (column 1) and 4.4% more investment in offshore markets (column 3). We take the average EPU of countries where each of the multinationals’ subsidiaries are located. Interestingly, in columns (2) and (4), there does not appear to be a significant relation between foreign EPU and firms’ investment decisions. Therefore, it seems likely that risk avoidance due to the EPU in the Chinese mainland may be the reason the multinational firms have more offshore investments.

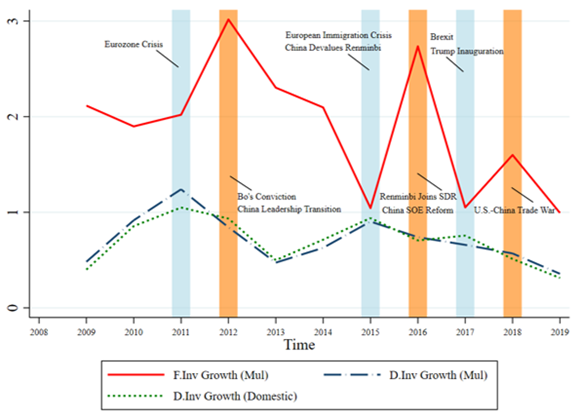

We illustrate the main ideas above in Figure 2. During the periods of China’s leadership transition, the reform of state-owned enterprises (SOEs), the renminbi’s access to special drawing rights (SDR), and the US–China trade war, there were significant spikes in multinational firms’ offshore investments, but such spikes did not exist among the firms without foreign sales. These results suggest that the Chinese multinationals increase offshore investment possibly to avoid policy uncertainty in the Chinese mainland.

Figure 2: Investment Allocations of Chinese Multinational Firms

This figure plots the average growth rate of offshore and domestic investment by Chinese nonfinancial listed firms from 2009 to 2019. The red solid line plots the growth rate of offshore investment of multinational firms. The blue dashed line depicts the multinational firms’ investment growth on the domestic market (i.e., the Chinese mainland). The green dotted line describes the investment growth of the Chinese domestic firms. The orange shaded areas indicate high policy uncertainty in China. The blue shaded areas indicate high uncertainty in global markets.

Table 1: Economic policy uncertainty and multinationals’ investment

The table presents the estimates of the impact of economic policy uncertainty on the relationship between foreign business exposures and firms’ investment policies. Fsp. is the ratio of a firm’s foreign sales scaled by total sales. The measure of economic policy uncertainty is from Baker et al. (2016). We separately measure firms’ exposure to the EPU on the domestic market (On.EPU) and on the offshore markets (Off.EPU). All regressions include firm and year fixed effects. Standard errors are corrected at the industry level, and associated t-statistics are in parentheses. *, **, and *** indicate statistical significance at the 10%, 5%, and 1% level, respectively.

We conduct a series of robustness tests for additional possible explanations. First, we find that non-state-owned enterprises (non-SOEs) have more capital expenditures than SOEs, so the offshore investment is unlikely to be policy driven. Second, we find that in booming markets, either domestic or foreign, multinationals tend to increase domestic investment. Thus, access to foreign capital is unlikely to explain the higher offshore investment. Third, multinationals underperform the domestic firms, and the performance is even worse for the offshore subsidiaries. It is unlikely that investment opportunities drive multinationals’ offshore investment. Fourth, we test the differences between China and the offshore subsidiaries’ countries in languages, religions, tax regimes, and exchange rates. There do not appear significant effects of these factors on the sensitivity between the firms’ foreign business exposure and their investment allocations. Fifth, multinational firms are more likely to allocate offshore investment in capital-intensive industries that have high investment irreversibility, as well as in R&D- intensive industries that have high innovation risk. These results imply that multinational firms are motivated by risk avoidance to make offshore investments.

This paper is most related to the emerging literature on the internal capital markets of multinational firms (Pinkowtiz, Stulz and Williamson 2012; Dinc and Erel 2013; Fernandes and Gonenc 2016). Recent studies show that financial shocks can be internationally transmitted through a firm’s subsidiaries. For instance, Bena, Dinc and Erel (2020) find multinational firms propagate economic declines from subsidiaries in countries with economic downturns to the investment declines of subsidiaries not experiencing a downturn. Wu and Ye (2021) show that global financial uncertainty has a contractionary effect on the real investment for foreign-invested enterprises in China. In this paper, we evaluate the international transmission of policy uncertainty via multinational firms’ subsidiary networks.

This paper adds to the literature on the determinants of cross-border capital flows. Despite extensive theoretical models and macro-level evidence on the functions of capital flows across countries, micro-level evidence on firms’ cross-country capital allocation has been relatively scarce. (Branson and Henderson 1985; Obstfeld 2004; Gourinchas and Jeanne 2006; Tille and Wincoop 2010). Our paper shows that Chinese multinational firms allocate offshore investment mainly to avoid domestic uncertainty.

Taken together, our analysis provides evidence on Chinese multinational firms’ investment allocations across domestic and offshore markets. Specifically, the results in this study show the importance of a clear, stable, and transparent policy environment for avoiding capital outflows and boosting private investment in the domestic market.

Note 1: See “China: The rise of a trade titan”, by UNCTAD, April 27, 2021.

Note 2: See “ ‘Back door’ capital outflows should worry Beijing”, by Wall Street Journal, Oct. 14, 2019. “Yuan eases on dollar demand, capital outflow concerns” by Reuters, Feb. 21, 2021, and “China’s epic battle with capital flows is more intense than ever”, by Bloomberg, Apr. 6, 2021.

[Dongxu Li,assistant professor at WangYanan Institute for Studies in Economics (WISE) & School of Economics, Xiamen University; Xiaoxue Hu, M.Phil. student at School of Economics, Xiamen University.]

References

Bena, J., Dinc, S. and Erel, I. (2020). The international propagation of economic downturns through multinational companies: The real economy channel. National Bureau of Economic Research, No. w27873.

Branson, W. H. and Henderson, D. W. (1985). The specification and influence of asset markets. Handbook of International Economics, 2, 749–805.

Dinc, I. and Erel, I. (2013). Economic nationalism in mergers and acquisitions. Journal of Finance, 68(6), 2471–2514.

Fernandes, N. and Gonenc, H. (2016). Multinationals and cash holdings. Journal of Corporate Finance, 39, 139–154.

Gourinchas, P. O. and Jeanne, O. (2006). The elusive gains from international financial integration. Review of Economic Studies, 73(3), 715–741.

Hu, Xiaoxue and Li, Dongxu, Foreign business exposure, policy uncertainty and capital flight from home: Evidence from China (2021). Working Paper. Available at SSRN: https://ssrn.com/abstract=3904653 or http://dx.doi.org/10.2139/ssrn.3904653.

International Monetary Fund (IMF). (2012). The liberalization and management of capital flows,” Policy Paper, International Monetary Fund, Washington.

Lam, W. R., Rodlauer, M., and Schipke, A. (2017). Modernizing China: Investing in Soft Infrastructure. International Monetary Fund.

Obstfeld, M. (2004). Globalization, macroeconomic performance, and the exchange rates of emerging economies. National Bureau of Economic Research, No. w10849).

Pinkowitz, L., Stulz, R. M. and Williamson, R. (2012). Multinationals and the high cash holdings puzzle. National Bureau of Economic Research, No. w18120.

Tille, C. and Van Wincoop, E. (2010). International capital flows. Journal of International Economics, 80(2), 157–175.

Wu, S. J., and Ye, H. (2021). FIEs and the transmission of global financial uncertainty: Evidence from China. Working Paper.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email