Housing Wealth and Online Consumer Behavior: Evidence from the Xiong’an New Area in China

We provide new evidence on the causal effects of housing wealth on consumer behavior. To overcome the empirical challenge of non-random housing wealth changes, we exploit the unexpected announcement of China’s national-level new area—Xiong’an New Area—on April 1, 2017 as an exogenous shock to housing prices. We use a proprietary dataset of individual-level online consumption from the largest e-commerce company in China to measure various aspects of consumer behavior, such as consumption patterns, purchase hesitation, tolerance of unsatisfactory products, and shirking (as proxied by making online purchases during work hours). We also explore the underlying mechanisms and disentangle the realizable and unrealizable housing wealth effects.

Housing wealth accounts for a considerable portion of household net worth, particularly in China, and therefore fluctuations in housing wealth can have a substantial impact on household consumption (Campbell and Cocco 2007, Aladangady 2017, Waxman et al. 2020, Guren et al. 2021). However, moving beyond the focus on consumer spending itself, the question of how housing wealth affects consumer behavior has not been fully explored due to the lack of accurate behavioral measures and the difficulties of finding credibly exogenous variations in housing wealth required for causal inference. The answers to the above questions, however, are crucial because they have important implications to policymakers who aim to manage aggregate consumption demand, to sellers who try to understand consumer behavior so as to maximize profits, and to academics who attempt to explore the underlying mechanisms. Moreover, when investigating the underlying mechanisms, it is particularly challenging to find a clean setting to distinguish between the effects of realizable and unrealizable housing wealth, where realizable (unrealizable, respectively) housing wealth refers to housing wealth that can (can’t, respectively) be realized by selling the property.

To shed light on the causal impacts of housing wealth on consumer behavior, our recent working paper (Fang, Wang, and Yang 2022) exploits a unique policy event and a proprietary online consumption dataset provided by the largest e-commerce company in China. Specifically, we study the establishment of the Xiong’an New Area, which is the 19th state-level new area in China and was jointly announced by the Central Committee of the Communist Party of China and the State Council on April 1, 2017. Before the announcement, all pertinent information, including geographic coverage, administrative committee members, and announcement date, was kept in the strictest confidence. Therefore, the announcement of Xiong’an New Area creates a clean and exogenous shock to housing wealth.

In this study, we answer four research questions. First, what are the impacts of housing price changes on various online consumer behaviors? Second, do these impacts change over time? Third, what are the underlying mechanisms; in particular, what are the differential impacts on consumption behaviors between the realizable and unrealizable housing wealth effects? And fourth, are the impacts different across different types of consumers and product categories?

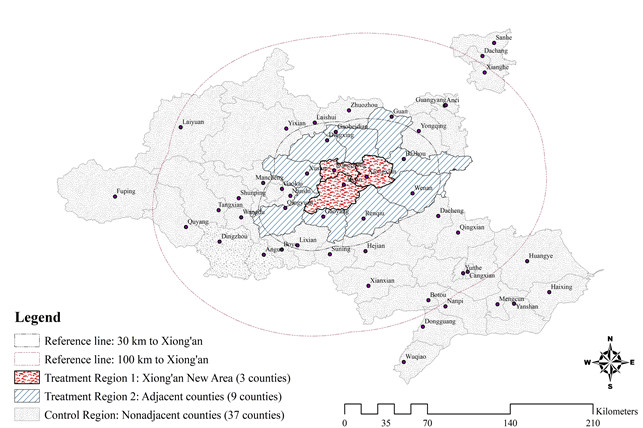

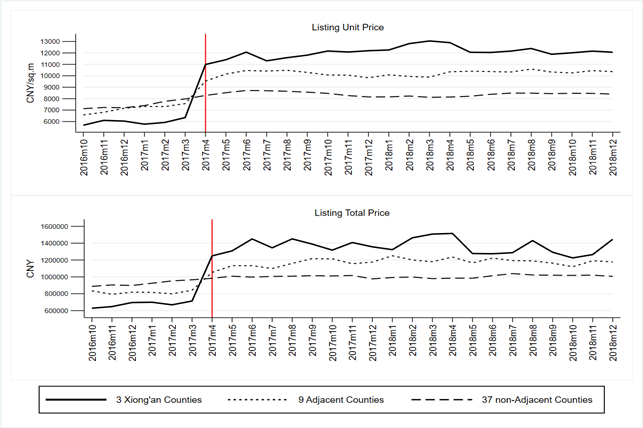

We first quantify housing market responses to the announcement of the Xiong’an New Area using a difference-in-differences (DID) approach. Specifically, as shown in Figure 1, we create three groups of counties that were subject to the announcement at different levels: the three counties in the Xiong’an New Area proper (C3 hereafter); the nine counties adjacent to the Xiong’an New Area (C9 hereafter); and the 37 counties that are non-adjacent to Xiong’an (C37 hereafter). It should also be emphasized that the government imposed a ban on real estate transactions on April 2, 2017 in C3 counties, but not in C9 and C37 counties. We use this unique ban to differentiate the impacts of realizable and unrealizable housing wealth effects. With property prices in C3 and C9 skyrocketing overnight following the announcement (as shown in Figure 2), residents within and around the new area were overjoyed to find themselves sitting on a potential “goldmine.” Thus, we define consumers in C3 and C9 as different treatment groups, whereas those in C37 serve as a control group. The results show that the announcement caused listing prices of properties in C3 and C9 to increase by 65.70% and 24.86%, respectively, relative to the housing prices in C37.

Figure 1: Geographic Coverage of Treatment and Control Counties.

Figure 2: Housing Market Trends in C3, C9, and C3.

We then implement the DID strategy to examine the responses of consumer behavior to the housing wealth shock using online consumption data, which contain the universe of transactions of 0.1% randomly selected active sellers from the e-commerce company between October 2016 and December 2018. The estimation sample in the baseline analyses includes around 3.65 million online orders made by 44,496 local consumers in C3, 230,148 local consumers in C9, and 683,548 local consumers in C37.

Specifically, local consumers are those with delivery addresses in a specific county during our sample period. The great granularity of our online transaction data enables us to examine a set of novel measures of consumer behavior: consumer hesitation or delay in payment, willingness to return purchased goods, propensity to make online purchases during work hours, preference for discounted products, and tendency to upgrade consumption level.

References

Aladangady, Aditya. 2017. “Housing Wealth and Consumption: Evidence from Geographically Linked Microdata.” American Economic Review 107, 3415–46. https://doi.org/10.1257/aer.20150491.

Campbell, John Y., and João F. Cocco. 2007. “How Do House Prices Affect Consumption? Evidence from Micro Data.” Journal of Monetary Economics 54 (3): 591–621. https://doi.org/10.1016/j.jmoneco.2005.10.016.

Fang, Hanming, Long Wang, and Yang Yang. 2022. “Housing Wealth and Online Consumer Behavior: Evidence from Xiong’an New Area in China.” NBER Working Paper No. 30465. https://doi.org/10.3386/w30465.

Gu, Quanlin, Jia He, Wenlan Qian, and Yuan Ren. 2021. “Housing Booms and Shirking.” SSRN Working Paper. http://dx.doi.org/10.2139/ssrn.3189933.

Guren, Adam M., Alisdair McKay, Emi Nakamura, and Jón Steinsson. 2021. “Housing Wealth Effects: The Long View.” Review of Economic Studies 88: 669–707. https://doi.org/10.1093/restud/rdaa018.

Waxman, Andrew, Yuanning Liang, Shanjun Li, Panle Jia Barwick, and Meng Zhao. 2020. “Tightening Belts to Buy a Home: Consumption Responses to Rising Housing Prices in Urban China.” Journal of Urban Economics 115, 103190. https://doi.org/10.1016/j.jue.2019.103190.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email