Discounting Chinese Industrial Policy

The Chinese government supports the development of dozens of industries today, but the long-run sustainability of this model depends crucially on policy efficiency. Using a comprehensive dataset of all industrial policy announcements by China’s State Council from 2008 to 2022, we find that policy uncertainty introduces a novel financial cost that reduces the efficiency of Chinese industrial policy. Industrial policy increases firm value, but investors heavily discount this support because of the risk that policies may abruptly and arbitrarily change.

Each year China’s central government issues dozens of industrial policies, supporting hundreds of publicly listed firms and many more unlisted firms. Chinese industrial policy has succeeded in building global leaders across many industries, including shipbuilding, photovoltaics, and electric vehicles. However, the long-term success of this model depends on its efficiency, which has been difficult to empirically measure and evaluate (Wei et al. 2023). In our study (Sinclair and Zhang 2023), we document a new channel of efficiency loss that arises from industrial policy uncertainty.

As any investor in China knows, government policies are powerful but can be highly uncertain. After an industrial policy is announced, investors face uncertainty about the future realized value of support. Will a specific firm receive subsidies? How large will the subsidies be? And how long will the subsidies last? Policy uncertainty is costly (Baker, Bloom, and Davis 2016), and indeed we find that investors undervalue firms that are subject to industrial policy uncertainty (IPU). This creates a shadow financial cost of industrial policy, where, in essence, one yuan of expected policy support is valued at less than one today because of policy uncertainty.

To develop our analysis, we build a database of industrial policy announcements using the official policy archive of the State Council, the de facto highest organ of state power in China. We use textual analysis to study the 2,663 policy documents published between March 28, 2008, and May 27, 2022. We identify 1,574 administratively important documents, and of these, 314 provide explicit policy support for 53 industries, covering 2,908 of the 4,288 listed firms during this period. The sample includes all A-share stocks from the main boards of the Shanghai and Shenzhen Stock Exchanges as well as the Growth Enterprise Market (GEM) board.

Chinese industrial policies are starkly different from industrial policies in the West. For example, US policy is implemented as statutory law that clearly defines the funding quantity, budget, and duration. These laws also provide clear and detailed rules for what firms must do to obtain funding, as the 394-page CHIPS Act attests to. Policy uncertainty exists while the legislation works its way through Congress, but there is relatively low uncertainty once the policy is signed into law.

Chinese industrial policy, however, is implemented as administrative policy. These are documents handed down from the central government to local government officials. Local governments are instructed to support the development of various industries, but there are no fixed details on the funding quantity, budget, or duration. This gives both the central and local governments flexibility. The central government has the flexibility to issue new policies, or to revise existing policies, and local governments have the flexibility to use many different channels to support development. They can provide land, subsidies, tax breaks, administrative support, bank loans, business support, and indeed we show that firms that receive strong policy support subsequently pay less taxes, take on more short-term debt, earn higher operating revenue, and increase R&D spending.

This is the flexibility and dynamism that Chinese industrial policy is known for, but this flexibility also means that any policy can change, and thus, it is unclear how long a given policy will last. Local government officials are evaluated on policy implementation, but which policies are to be implemented? If the central government discussed a particular policy last year, but the policy was not mentioned this year, then the policy is likely no longer a top priority, and local officials will direct their resources elsewhere.

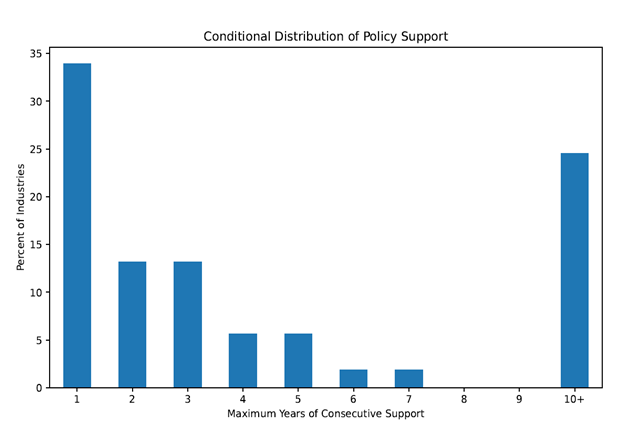

Thus, continued policy support can make or break a firm’s success, and this is the core of Chinese industrial policy uncertainty. Conditional on receiving support this year, there is a 36.2% probability that the central government will stop providing policy support the following year. Figure 1 demonstrates that when a supportive policy is announced, investors do not know if support will last for only one year (34.0% of industries) or over a decade (24.5% of industries). For the firm and investors, there is a big difference in the present value of one year of policy support versus ten years of support.

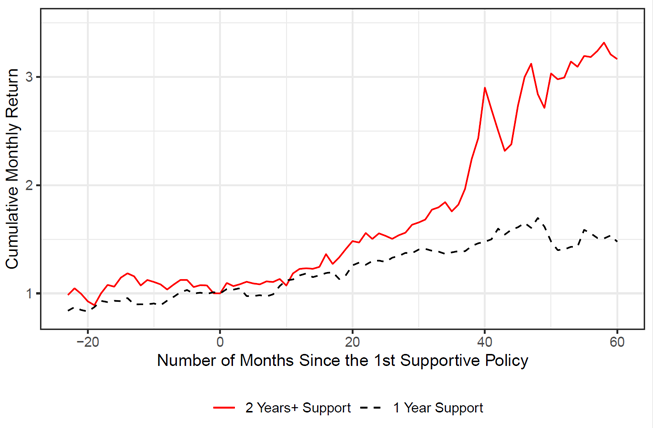

Figure 2 plots the average cumulative returns for firms that receive only one year of support (dashed black line) and those that receive two or more years of support (solid red line). At the initial announcement of a supportive policy, it is unclear whether a particular firm will be on the black line or the red. The uncertainty is only resolved over time and industries that continuously receive support vastly outperform those for which support abruptly ends.

Figure 2 depicts the payoffs to a risky gamble; if you invest following the announcement of a supportive policy, then your investment will either go up substantially or remain relatively flat. Investors do not like risk, and if this industrial policy uncertainty is non-diversifiable, then investors will demand excess returns for bearing this risk (Pástor and Veronesi 2013). Our main analysis investigates whether these supported stocks do in fact earn high abnormal returns.

But first, Chinese industrial policy uncertainty is likely a non-diversifiable risk. Diversification depends on a large pool of stocks in which a firm’s idiosyncratic risk can be cancelled out. This works when one stock faces a unique risk in a pool of more than 4,000, but at any given time, about one-third of listed firms in China are subject to IPU risk, and thus it is likely impossible for investors to diversify away this risk in the domestic equity market. Furthermore, capital controls prevent domestic investors from diversifying IPU risk using a global pool of assets.

We build a simple stock trading portfolio to measure how investors value industrial policy uncertainty. Every month we invest in firms that have received positive policy support over the past year. For these firms, there is uncertainty about continued support and thus the future value of support. This is a very simple strategy that anyone can employ; it simply invests following the lead of the central government.

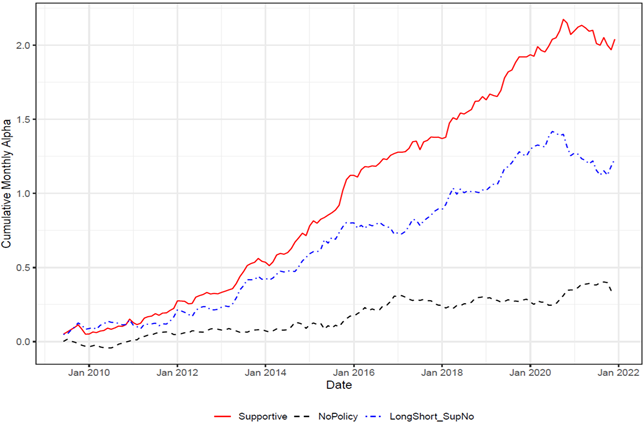

Our IPU portfolio indeed earns excess risk-adjusted returns, suggesting that investors undervalue firms subject to policy uncertainty. On a value-weighted basis, small supported firms earn statistically significant risk-adjusted excess returns (alphas) of 12.0% (CAPM), 6.0% (Carhart), and 7.2% (CH4) per year. Figure 3 (red line) plots the cumulative monthly excess returns for small supported firms under the CH4 model (Liu, Stambaugh, and Yuan 2019). These excess returns represent an economically large, persistent, and predictable discount relative to the future value of the firm and demonstrate that the market undervalues supported firms.

Consistent with the risk premium hypothesis, Figure 3 demonstrates that investors consistently earn excess returns except during periods when policy risks are realized. The IPU portfolio of small supported firms reliably produces excess returns until November 2020, when the tech crackdown was initiated. The tech crackdown was an abrupt and unanticipated reversal of industrial policy, in which stocks that previously enjoyed policy support were disproportionately affected.

An important concern is that industrial policy support is not random and the government, either deliberately or incidentally, selects industries that produce high excess returns in the future, just as a skilled hedge fund manager does. However, the difference is that hedge fund managers keep their decisions private, whereas government policy announcements are public. If the government simply “picks winners,” then financial market participants would easily arbitrage away the predictable returns that we document. Chinese investors are indeed attentive to price predictability; Carpenter, Lu, and Whitelaw (2021) demonstrate that the price efficiency in China’s stock market is comparable to the US market, and we find no evidence that our results are driven by inattentive investors.

In addition, we perform several robustness checks on our main IPU portfolio analysis. The excess risk-adjusted returns to the IPU portfolio are not due to (1) a size or shell-value effect, (2) policy classification errors, (3) the outperformance of the tech sector, (4) an R&D risk premium, or (5) extrapolative beliefs.

Our study documents a novel financial cost of Chinese industrial policy. Due to policy uncertainty, investors persistently undervalue supported stocks. This increased uncertainty raises the relative cost of capital for supported firms, and thus reduces the efficiency of industrial policy support.

References

Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. “Measuring Economic Policy Uncertainty.” Quarterly Journal of Economics 131 (4): 1593–1636. https://doi.org/10.1093/qje/qjw024.

Carpenter, Jennifer N., Fangzhou Lu, and Robert F. Whitelaw. 2021. “The Real Value of China’s Stock Market.” Journal of Financial Economics 139 (3): 679–96. https://doi.org/10.1016/j.jfineco.2020.08.012.

Liu, Jianan, Robert F. Stambaugh, and Yu Yuan. 2019. “Size and Value in China.” Journal of Financial Economics 134 (1): 48–69. https://doi.org/10.1016/j.jfineco.2019.03.008.

Pástor, Ľuboš, and Pietro Veronesi. 2013. “Political Uncertainty and Risk Premia.” Journal of Financial Economics 110 (3): 520–45. https://doi.org/10.1016/j.jfineco.2013.08.007.

Sinclair, Andrew J., and Chuyi Zhang. 2023. “Discounting Industrial Policy.” Working Paper.

Wei, Shang-Jin, Jianhuan Xu, Ge Yin, and Xiaobo Zhang. 2023. “Mild Government Failure.” NBER Working Paper No. 31178. https://doi.org/10.3386/w31178.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email