The Pre-Announcement Drift in China: Government Meetings and Macro Announcements

Confirming conventional wisdom that the Chinese equity market is policy-driven, we document a significant positive stock return—which we refer to as the pre-Govt return—on Chinese equity over the 48-hour window before the announcement of top government meetings, similar to the pre-FOMC drift in US equity. The pre-Govt return in China is particularly large under heightened uncertainty and is related to initial selling and subsequent buying by institutional investors.

Political events and decision-making by sovereign governments can have a profound impact on financial markets, an observation made apparent amid growing geopolitical tensions in recent years. This is especially true in China, where economic policy making, including the overall direction of monetary, fiscal, and industrial policies, takes place at the highest level of the government. The literature has discussed the impact of political uncertainty on asset prices (Pástor and Veronesi 2012, Pástor and Veronesi 2013). While the Chinese equity market is widely viewed as policy-driven, the channel through which policy uncertainty affects asset pricing has not been well studied. Ex-post, there is ample evidence that abrupt and sometimes idiosyncratic changes in government policy have drastic market impact (Liu, Shu, and Wei 2017). Ex-ante, however, the market price of such policy uncertainty has yet to be identified and quantified. Following the pre-announcement literature (Savor and Wilson 2013, Lucca and Moench 2015, Hu et al. 2022), we study this problem from the unique angle of the market’s anticipation before the announcement of the regularly held top government meetings in China. In such a top-down economy, meetings of the central government are highly anticipated and a source of speculation for domestic investors, akin to Federal Open Market Committee (FOMC) meetings in the US.

We focus on the central government meetings held roughly seven times per year and presided over by top leaders in China. These include the Party Congress of Chinese Communist Party (全国代表大会) and its plenums (中央全会), the Politburo meetings (中央政治局会议) on economic affairs, and the annual political convention referred to as the “Two Sessions” (全国两会). We define the pre-Govt return as the pre-announcement returns of the aggregate stock market in China over the 48-hour window before the announcements of these top government meetings. To assess the relative importance of the pre-Govt return, we further conduct a comparative analysis with other pre-announcement returns before the release of important macroeconomic indicators in China, including M2, CPI, and GDP. While the Party Congress, the plenums of the Central Committee, and the Two Sessions are all pre-scheduled and publicly announced, the specific dates of the monthly Politburo meetings are not disclosed to the public in advance. The M2 announcements are also unscheduled to the public (Guo, Jia, and Sun 2023). For the prescheduled meetings we designate the first day of the meeting as the event day, while for the unscheduled meetings we identify the event day as the first trading day after the actual meeting. For simplicity, we refer to the event day as the announcement day hereafter.

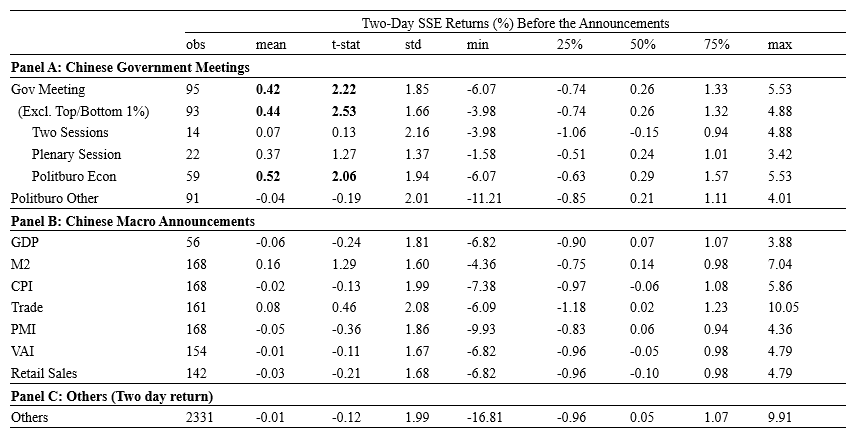

Figure 1 shows the overall reaction of China’s stock market (SSE Composite Index) in anticipation of top government meetings. The aggregate stock market in China demonstrates a pronounced upward drift in anticipation of the government meetings, reaching its peak on the day of the government meeting announcements, which is shaded in grey in Figure 1. We report in Table 1 that the average pre-Govt return over the two-day window prior to the government meeting announcements is 42 basis points with a t-stat of 2.22.

Figure 1. Cumulative Chinese Stock Market Returns around Government Meetings

Note: This figure shows the average cumulative returns over five-minute blocks on the SSE Composite Index on the five-day announcement window. The solid blue line captures the average cumulative returns across all five-day windows. The blue shaded areas denote the point-wise 95% confidence bands.

Table 1: The Pre-Announcement Returns in China

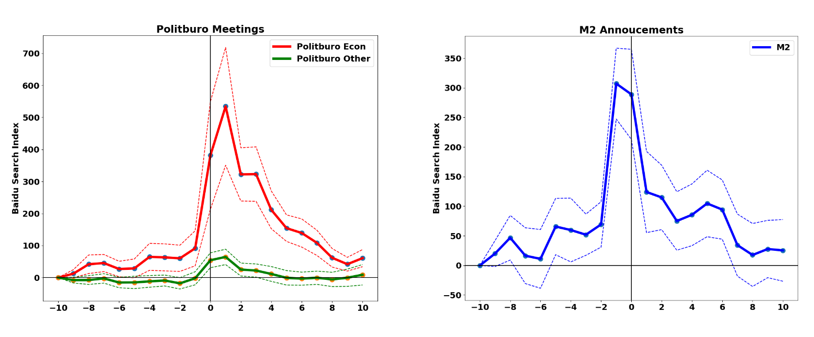

The pre-announcement returns associated with the different categories of government meetings as well as macro announcements are also reported in Table 1. We find the pre-announcement drift before the Politburo meetings on macroeconomics to be the highest, while the market does not respond to the Politburo meetings on non-economic issues. This difference in pre-announcement drift between the Politburo meetings on economic and non-economic affairs is also consistent with the Baidu search index as a proxy for markets’ anticipations, as depicted in Figure 2. The Baidu search index exhibits a noticeable increase starting four days prior to the Politburo Econ meetings while it begins to rise only on the actual day of the Politburo Other meetings. This pattern suggests that investors are able to discern the approximate timing of Politburo Econ meetings and intensify their attention and information-seeking activities as the Politburo Econ meetings draw near, even though the specific meeting dates are not publicly disclosed. When comparing the Baidu search index of Politburo meetings and M2 announcements, it is evident that investors pay more attention to Politburo Econ meetings, as indicated by higher pre-announcement return in Table 1 as well as higher search intensity in Figure 2.

Figure 2. Baidu Search Index

Note: The figure plots the average cumulative change of in the Baidu search index of “Politburo meeting (政治局会议)” around the Politburo meeting announcement and “M2” around M2 announcements in calendar days.

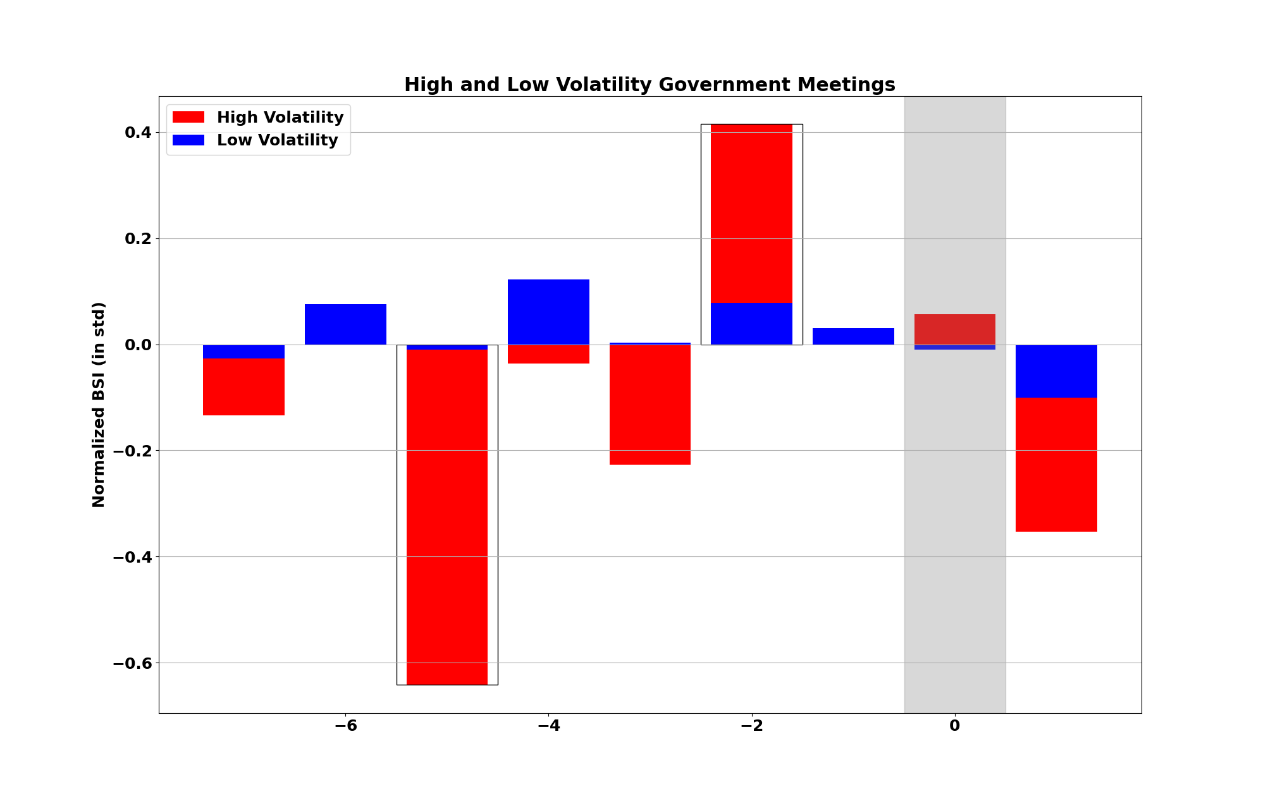

We find that market uncertainty plays a crucial role in explaining pre-Govt returns. For the Chinese market, we use the realized market volatility during the accumulation period that begins at seven days and ends at four days before the announcement as the main conditioning variable to examine the cross-meeting variation in pre-Govt drift. We sort top government meetings into two groups, with the high-uncertainty group containing meetings with above-median market uncertainty and the low-uncertainty group containing the rest. Figure 3 repeats the same plot of high-frequency cumulative SSE returns as in Figure 1, demonstrating a stark contrast between pre-Govt returns under high- and low-market uncertainties. To the extent that there is a positive and significant pre-Govt drift, it is driven exclusively by the high-uncertainty group.

Note: Chinese government meetings are sorted by average daily realized stock volatility in the accumulation period, with “High” containing government meetings ranked in the top 50% in average realized intra-day stock volatility and “Low” containing the rest.

As further evidence in support of the channel of heightened uncertainty, we take advantage of publicly available level-2 data from Wind Financials in China to examine patterns of institution trading in anticipation of Chinese government meetings. We calculate the index-level buy-sell imbalances (BSI) for large institutions by subtracting the aggregate sell trading volume from the buy trading volume for orders larger than 1 million RMB. Figure 4 shows that institution investors are net sellers of the SSE index five days ahead and then become net buyers two days before the announcement of the government meeting. This trading behavior of large institutional investors aligns with the heightened uncertainty channel. During the accumulation period, institutional investors anticipate the forthcoming critical government meeting, which is associated with a substantial level of impact uncertainty. As a result, investors may choose to temporarily withdraw from the market, selling more shares to reduce their risk exposure. As the event day approaches, investors, especially sophisticated institutional investors with an advantage in information gathering, acquire more information about the impact uncertainty of the upcoming meeting. Along with the resolution of uncertainty, such investors return to the market buying more stocks. Importantly, this unique trading pattern exists only in the high-uncertainty group, connecting it directly to the significant presence of the pre-Govt drift.

Figure 4. Institutional Trading Around Government Meetings

Figure 5. Time Series of Cumulative Pre-Announcement Return

Note: This figure documents the cumulative pre-announcement drift over time. The black line shows the actual evolution of the SSE index (Small-minue-big factor) on the left (right) plot. The red line shows a hypothetical time series that is constructed by taking into account only the pre-announcement drift. The blue line shows a hypothetical time series that is constructed by taking into account only the return that occurred on days outside the pre-announcement and the post-announcement window.

Focusing on the pre-announcement returns of the macro announcements such as M2, we find that while the pre-M2 drift is absent in the aggregate stock market reported in Table 1, there is in fact a strong pre-M2 drift in the small-minus-big (SMB) portfolio in Table 2, indicating that the small-cap stocks are more sensitive to the M2 announcements. Figure 5 plots the time series of the pre-Govt SSE (pre-M2 SMB) cumulative return against all trading days as well as the days outside the Govt (M2) window. While the pre-Govt (pre-M2) window accounts for only a small fraction of the total number of trading days, the pre-Govt (pre-M2) cumulative return accounts for a substantial portion of the full-sample cumulative return. Moreover, we find evidence to support the heightened-uncertainty channel in explaining the pre-M2 drift in the SMB portfolio in Table 2. Specifically, just as the realized market volatility during the accumulation period can predict the pre-Govt drift in the aggregate market, it can also predict the pre-M2 drift in the SMB portfolio. The R-squareds of these two predictive regressions are 22% and 25%, respectively. The heightened anticipation of top government meetings impacts the aggregate stock market, while that of the M2 announcements affects the small-cap stocks.

Table 2: The Pre-Announcement Return for the Market, Size, and Value Portfolios

Overall, our empirical results contribute to the existing literature by documenting the pre-announcement drift before the highly anticipated and speculated events in China that are associated with top government meetings. It is a new and important addition to the pre-announcement literature, as well as a confirmation that China is indeed a top-down economy with policy-driven markets. To the best of our knowledge, we are the first in the literature to provide an in-depth study on the asset pricing impact of top government meetings in China. We further show that top government meetings in China command a higher pre-announcement premium for heightened uncertainty in the aggregate Chinese stock market than important macro announcements such as M2 announcements, underscoring the dominance of the Chinese central government over its financial markets.

(Jun Pan, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University; Qing Peng, Shanghai Advanced Institute of Finance, Shanghai Jiao Tong University.)

References

Guo, Rui, Dun Jia, and Xi Sun. 2023. “Information Acquisition, Uncertainty Reduction, and Pre-Announcement Premium in China.” Review of Finance 27(3), 1077–1118. https://doi.org/10.1093/rof/rfac042.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email