Has COVID-19 permanently changed the nature of economic shocks on the Chinese economy?

We construct a detailed dataset of major expenditure components of GDP in nominal and real terms at a quarterly frequency. This dataset is valuable for macroeconomic analysis. We use it to study the primary drivers of China’s economic fluctuations before and during the COVID-19 era. Our finding that consumption-constrained shocks have exerted a significant impact on GDP and household consumption, particularly during and beyond the COVID-19 period, sheds light on how crises can permanently alter the nature of economic shocks in China.

Over the past four decades, China has experienced sustained growth. At the same time, its macroeconomy has also undergone significant fluctuations, particularly during the global financial crisis (GFC) and the COVID-19 pandemic. Unlike the GFC and other economic slowdowns, the recovery of the Chinese economy after COVID-19 has been lackluster, with 5.2% year-over-year real GDP growth in 2023, much lower than expected by the public. The dramatically different path of the recovery of the Chinese economy from COVID-19 relative to past slowdowns raises the question of whether the pandemic has permanently changed the nature of economic shocks on the Chinese economy.

In answering this question, however, we are faced with two data challenges. First, the reliability of China’s official annual and quarterly GDP data has been much debated in the literature (Chen et al. 2019; Clark, Pinkovskiy, and Sala-i-Martin 2020; Wu and Li 2021). Second, and arguably more urgent, is the lack of quarterly data on expenditure-based GDP and its components. This data is essential for research on China’s macroeconomic fluctuations, especially since the COVID-19 outbreak. Fernald, Hsu, and Spiegel (2021) find that quarterly data on value-added measures of GDP, provided by China’s National Bureau of Statistics (NBS), was excessively smooth between 2008 and 2016.

In a recent paper (Chen, Higgins, and Zha 2024), we address the second challenge and construct a comprehensive dataset of expenditure-based GDP (“GDP-exp” hereafter) and its components in both nominal and real terms at a quarterly frequency. We then apply a two-stage structural vector autoregression (SVAR) model to this dataset to explore the principal drivers of China’s economic fluctuations across different episodes. Our findings reveal that consumption-constrained shocks, which were closely related to China’s COVID-19 lockdown policies during 2020Q1–2022Q4, has had stark and enduring impacts on expenditure-based GDP and all of its components, both during and after the COVID-19 pandemic.

Constructing quarterly expenditure-based GDP and its components

Our method for constructing quarterly data follows a two-stage approach. In the first stage, we follow Fernald, Hsu, and Spiegel (2021) to estimate the first principal component from their eight quarterly indicators without removing the trend. In the second stage, this principal component as well as GDP-related price and spending data serve as the main interpolators for obtaining the quarterly series for GDP-exp and its various components. Throughout this data construction process, we seasonally adjust all quarterly data.

The constructed quarterly series for GDP-exp, its principal expenditure components, and its consumption subcomponents avoid the excessive smoothness evident in the NBS’s official reports. This difference is visible in Figure 1, which demonstrates that our constructed quarterly GDP-exp exhibits greater volatility than the quarterly GDP series directly interpolated from the NBS-published data on quarterly value-added GDP. This quarterly time-series dataset, extending back to 2000Q1, offers researchers a valuable opportunity to examine an important yet understudied topic: macroeconomic fluctuations in China’s recent history.

Figure 1: Alternative Estimates of Quarterly Real GDP-exp Growth

Understanding sources of China’s economic fluctuations

We employ an SVAR approach on our quarterly time series to analyze the factors driving China’s economic fluctuations. Our identification strategy follows Brunnermeier et al. (2021), which enables us to examine multiple structural shocks and their varying impacts across different regimes. We estimate two models: one is the “GDP model,” which includes GDP and its components; the other is the “consumption model,” which studies the detailed impacts on consumption by including household consumption and its seven subcomponents. For both models, the COVID-19 period (2020Q1–2022Q4) is treated as a distinct regime. We also identify other regimes, such as the investment-driven period (Chen and Zha 2020) and the economic stimulus period for the GDP model. The qualitative and quantitative differences in the economic impacts of various shocks are remarkably stark.

We find that the key drivers of economic fluctuations in China vary significantly across different regimes. For instance, the external shock plays a dominant role during both the GFC period and the economic stimulus phase. In the pre-COVID-19 era, moreover, the economic stimulus shock exhibited the largest variations during the period of monetary and fiscal stimulus.

During the COVID-19 period, the predominant shock is the one restricting household consumption, which we call “consumption-constrained shock.” This shock leads to the most substantial fluctuations in GDP and its components, surpassing the effects of other shocks by an order of magnitude. We provide external validation of such a shock by calculating the quarterly GDP-weighted average stringency index across provinces and municipal cities. This index is derived from province-level stringency index data provided by Oxford University, and we estimate innovations to its AR(1) process. The correlation of these innovations with our identified consumption-constrained shocks is significantly high, with 0.47 for the GDP model and 0.62 for the consumption model. The high correlations suggest that the stringent COVID-19 lockdown policies are a likely source of this shock.

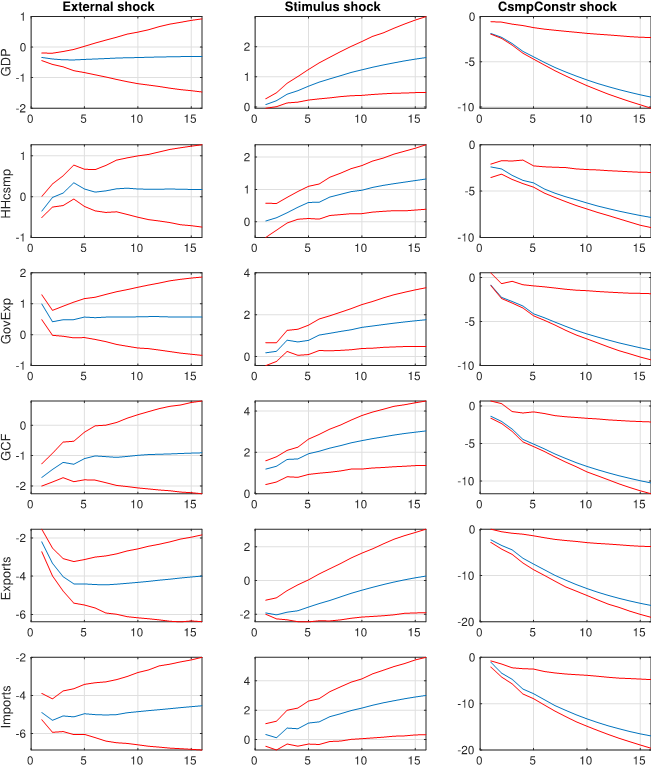

Different economic shocks had both qualitatively and quantitatively different impacts on GDP and its components (Figure 2). During the GFC period, the external shock had immediate and significantly negative effects on both imports and exports, but the response of household consumption was insignificant, both statistically and economically (Figure 2, left column), limiting the shock’s overall influence on GDP. The economic stimulus shock, most pronounced during the period of monetary and fiscal stimulus, resulted in a substantial and sustained increase in investment and government expenditures (Figure 2, middle column). Interestingly, although GDP responded positively and significantly to this stimulus shock, there was a sharp decline in exports during the initial five quarters—a decline that holds statistical significance. This negative export response can be attributed to the fiscal stimulus crowding out private manufacturing firms’ investment during the economic stimulus period, as discovered by Chen et al. (2023). Note that these manufacturing firms constitute a substantial portion of the export sector.

Figure 2: Impulse responses to three key structural shocks with 68% error bands in the GDP model. The label “GDP” stands for real GDP, “HHcsmp” for household consumption, “GovExp” for government consumption, and “GCF” for gross capital formation (investment).

During the COVID-19 period, the effects of both the external shock and the economic stimulus shock were dominated by those of the consumption-constrained shock, which had immediate and substantially negative impacts on all GDP components, particularly household consumption expenditures. As a result, GDP experienced a significant decline upon impact, and these adverse effects persisted beyond the COVID-19 period. Throughout the pandemic, various restrictions were imposed on both supply and demand in the economy, and our identified consumption-constrained shocks capture these unforeseen measures. Notably, this shock induced enduring and significantly negative effects not only on household and government consumption expenditures, but also on all other GDP components. Consequently, its influence on GDP was more pronounced than that of other structural shocks, leading to a prolonged downturn in GDP and all its components. This shock compelled households to reduce consumption, primarily due to social distancing measures and reduced income, leading to government shutdowns, business closures, declines in firm investment and imports of production intermediaries, transportation disruptions, and a decline in exports.

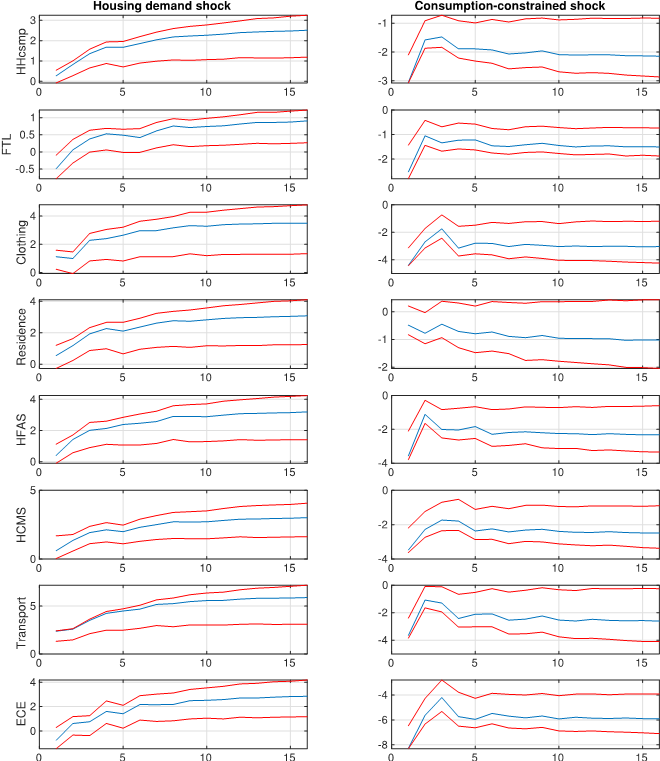

For the consumption model, we estimate housing demand shocks that were a key driver of consumption both before and after the COVID-19 period, as demonstrated in the left column of Figure 3. The consumption-constrained shock, however, is the only shock that immediately and significantly affects household consumption. Indeed, this particular shock had immediate and substantial impacts on both overall household consumption and its various subcomponents during the COVID-19 era (Figure 3, right column). The pronounced immediate effects on all subcomponents of household consumption persist for an extended period with high statistical significance, possibly due to the shock’s detrimental influence on households’ permanent income. As an important observation, education, culture, and entertainment (ECE); food, tobacco, and liquor (FTL); clothing; and household facilities and services (HFAS) experienced exceptionally severe impacts of this shock. A plausible explanation is that periodic COVID-19 lockdowns restricted households from participating in activities like dining out, buying clothing and household items, and attending cultural or entertainment events. No shocks prior to the outbreak of COVID-19 had such significant and immediate impacts on these consumption subcomponents.

Figure 3: Impulse responses to three key structural shocks with 68% error bands in the consumption model. The label “HHcsmp” stands for household consumption, “FTL” for food, tobacco, and liquor, “HFAS” for household facilities and services, “HCMS” for health care and medical services, “Transport” for transportation and communication, and “ECE” for education, culture, and entertainment.

Summary

In recent years, China has encountered various challenges, such as the downturn in its real estate sector, vulnerabilities in its financial system, and risks facing local governments for their financial soundness. The intricate connections among the real estate sector, the financial system, and the overall Chinese macroeconomy make these challenges even more daunting. We hope that our constructed data and empirical findings will motivate further study of the sources of economic fluctuations and their impacts on China.

(Kaiji Chen, Patrick Higgins, Tao Zha;

The views expressed herein are those of the authors and do not represent those of the Federal Reserve Bank of Atlanta, the Federal Reserve System, or the National Bureau of Economic Research.)

References

Brunnermeier, Markus, Darius Palia, Karthik A. Sastry, and Christopher A. Sims. 2021. “Feedbacks: Financial Markets and Economic Activity.” American Economic Review 111 (6): 1845–79. https://doi.org/10.1257/aer.20180733.

Chen, Kaiji, Haoyu Gao, Patrick Higgins, Daniel F. Waggoner, and Tao Zha. 2023. “Monetary Stimulus Amidst the Infrastructure Investment Spree: Evidence from China's Loan-level Data.” Journal of Finance 78 (2): 1147–1204. https://doi.org/10.1111/jofi.13204.

Chen, Kaiji, Patrick Higgins, and Tao Zha. 2024. “Constructing Quarterly Chinese Time Series Usable for Macroeconomic Analysis.” Journal of International Money and Finance 143: 103052. https://doi.org/10.1016/j.jimonfin.2024.103052.

Chen, Kaiji, and Tao Zha. 2020. “Macroeconomic Effects of China’s Financial Policies.” In The Handbook of China’s Financial System, edited by Marlene Amstad, Guofeng Sun, and Wei Xiong, 151–82. Princeton, New Jersey: Princeton University Press.

Chen, Wei, Xilu Chen, Chang-Tai Hsieh, and Zheng (Michael) Song. 2019. “A Forensic Examination of China’s National Accounts.” Brookings Papers on Economic Activity, Spring: 77–141. https://www.brookings.edu/articles/a-forensic-examination-of-chinas-national-accounts/.

Clark, Hunter, Maxim Pinkovskiy, and Xavier Sala-i-Martin. 2020. “China’s GDP Growth May Be Understated.” China Economic Review 62: 101243. https://doi.org/10.1016/j.chieco.2018.10.010.

Fernald, John G., Eric Hsu, and Mark M. Spiegel. 2021. “Is China Fudging its GDP Figures? Evidence from Trading Partner Data.” Journal of International Money and Finance 110: 102262. https://doi.org/10.1016/j.jimonfin.2020.102262.

Wu, Harry X., and Zhan Li. 2021. “Reassessing China’s GDP Growth Performance: An Exploration of the Underestimated Price Effect.” Research Institute of Economy, Trade, and Industry Discussion Paper Series 21-E-018. https://www.rieti.go.jp/jp/publications/dp/21e018.pdf.

Latest

Most Popular

- VoxChina Covid-19 Forum (Second Edition): China’s Post-Lockdown Economic Recovery VoxChina, Apr 18, 2020

- China’s Joint Venture Policy and the International Transfer of Technology Kun Jiang, Wolfgang Keller, Larry D. Qiu, William Ridley, Feb 06, 2019

- China’s Great Housing Boom Kaiji Chen, Yi Wen, Oct 11, 2017

- Wealth Redistribution in the Chinese Stock Market: the Role of Bubbles and Crashes Li An, Jiangze Bian, Dong Lou, Donghui Shi, Jul 01, 2020

- The Dark Side of the Chinese Fiscal Stimulus: Evidence from Local Government Debt Yi Huang, Marco Pagano, Ugo Panizza, Jun 28, 2017

- What Is Special about China’s Housing Boom? Edward L. Glaeser, Wei Huang, Yueran Ma, Andrei Shleifer, Jun 20, 2017

- Privatization and Productivity in China Yuyu Chen, Mitsuru Igami, Masayuki Sawada, Mo Xiao, Jan 31, 2018

- How did China Move Up the Global Value Chains? Hiau Looi Kee, Heiwai Tang, Aug 30, 2017

- Evaluating Risk across Chinese Housing Markets Yongheng Deng, Joseph Gyourko, Jing Wu, Aug 02, 2017

- China’s Shadow Banking Sector: Wealth Management Products and Issuing Banks Viral V. Acharya, Jun Qian, Zhishu Yang, Aug 09, 2017

Facebook

Facebook  Twitter

Twitter  Instagram

Instagram WeChat

WeChat  Email

Email